Wells Fargo, a well-known financial service provider company, can grant you a cashier check for the purchase of heavy items. See also (2022 Update) Ulta Credit Card Login, Payment, Customer Service, Cancellation, and More Detailed aspects of well Fargo cashier check Further, we recommend keeping a physical copy of check-in your record. Get the receipt to use as proof and for your record purpose. 3) Pay the amount and fee.Įnsure your bank account has enough money to pay the applicable fee after your check’s amount has been frozen or withdrawn. Choose the method and follow the procedure. Both the methods and their procedure have been discussed above. The next step is to choose which ordering method will you prefer, online or in-person. Also, you have to gather the check fee.Īlthough the check is made in the bank’s name and its fund, you are liable to pay the check fee to the bank to proceed with the process.

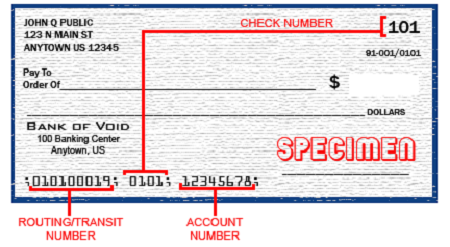

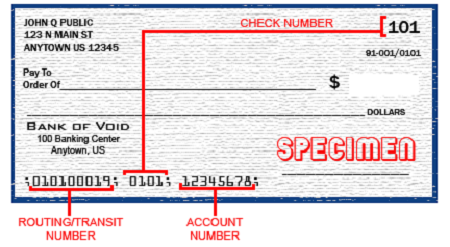

You have to provide the name of the business or person you will pay. The first thing you would be doing is getting the information ready because you cannot get a blank cashier check. Steps to take for ordering cashier check 1) Get the amount and the information ready However, there are certain steps in the process that includes the following.

You can order a Wells Fargo cashier’s check online or in person through the above-discussed ways.

Lastly, if you are not satisfied with any of the above methods, you can simply visit the nearest Wells Fargo location yourself to get the check. Now, you can get access to ordering the cashier’s check. If you are already signed in to your Online Banking account, go to the Accounts tab and select Order Checks and Currency. Or click this link to go to the website section. If the checks are valued at up to $2,000 each, you can simply visit the Wells Fargo website and order them. You can get it online through their website or visit them in person by going to the nearest location. Sign up for priority access at and lock your rates for the year.To assist in availing cashier checks, Wells Fargo has made online and in-person methods available for customers. We’re working tirelessly to ensure this reality. Your money should work for you 24/7 at no added cost. No more anxiety of switching between checking and savings accounts. OnJuno’s FDIC insured High Yield Checking Account can help you earn an industry-leading 1.20% on all deposits. Need a bank account without the fees or the anxiety? We're here to help While Wells Fargo offers extensive branch and ATM coverage with its national presence, near-zero interest rates and a bevy of hidden charges make their checking and savings accounts an expensive proposition for most consumers. International Transaction Fee - 3% on all foreign transactions. ATM Withdrawal Fee - $2.50 for out-of-network withdrawals and $5 for international withdrawals. Standard fee of $35 per returned item across all accounts. Insufficient Funds Fee - Unlike overdraft, the NSF fee is charged when a payment is returned due to insufficient balance. Overdraft Fee - $35 per overdraft across all accounts. Outgoing international wire transfer in USD fee → $45. Outgoing international wire transfer in foreign currency fee → $35. Outgoing domestic wire transfer fee → $30. Incoming international wire transfer fee → $16. Incoming domestic wire transfer fee → $15. Wells Fargo Savings Account Fees Wells Fargo Wire Transfer Fees Wells Fargo offers two types of savings accounts, Wells Fargo also offers specialized checking accounts for teenagers called Teen Checking and for low-credit applicants called Opportunity Checking. Wells Fargo offers three primary types of checking accounts, Read on to understand all the fees associated with the Wells Fargo account. Dig deeper and you’ll find more than fifteen different charges waiting to entrap you - from monthly maintenance fees to overdraft and wire transfer fees.īut fret not champ! We’re here to help. WELLS FARGO CHECK BOOK COST FREE

Large banks want you to believe that their accounts are free and easy to use. In search for a new bank account to store, save or spend your hard-earned money? Be warned! Behind those bright billboards of smiling grandmas in newly outfitted veneers lie a labyrinth of hidden fees.

0 kommentar(er)

0 kommentar(er)